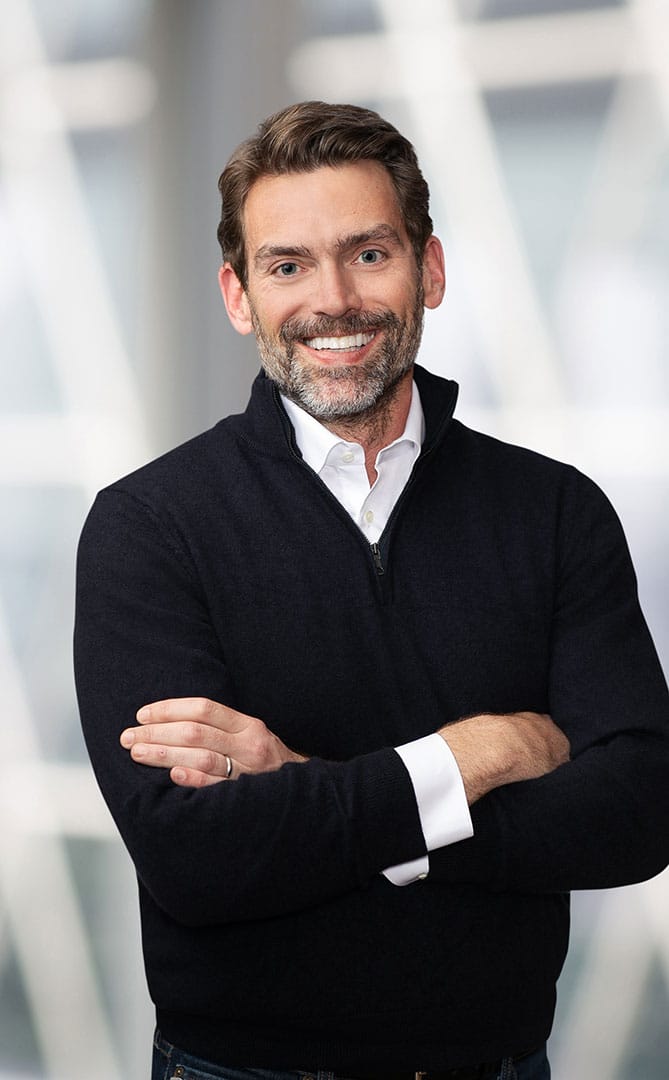

Jarrod Sharp helps clients achieve their project financing and commercial financing goals. For nearly a quarter century, Jarrod has guided banks, non-bank lenders, equity investors, developers, and business owners through complex financing strategies.

Jarrod is a demonstrated leader in the tax credit finance arena and is proud of his 20 years of experience using federal and state tax credit programs to spur economic activity in some of the most underserved low-income communities across the country.

Beyond tax credit financing, Jarrod represents banks and non-bank lenders in documenting, closing, and managing their C&I and commercial real estate debt facilities. He routinely works on cash-flow based loans, including leverage buyout financings, life insurance premium finance loans, leverage loans to private equity and debt funds, and guidance lines of credit and warehouse facilities used to finance the purchase of various types of securities and investment property.

- Mary Ranken Jordan and Ettie A. Jordan Charitable Foundation, Advisory Committee

- City Garden Montessori School, Board Member

- Member, 2016-17 Class of Leadership St. Louis, FOCUS St. Louis

- Panel: “Beyond the Basics of New Markets Tax Credit Workshops”

Novogradac New Markets Tax Credits Conference, October 2021 - Panel: “Advanced NMTC Concepts”

Novogradac New Markets Tax Credits Conference, January 2020 - Panel: “Hot Topics and Emerging Trends”

Novogradac New Markets Tax Credits Conference, October 2019 - Panel: “How to Submit a Winning NMTC Application”

Novogradac New Markets Tax Credits Conference, June 2019 - Panel: “Measuring Community Impact”

Novogradac New Markets Tax Credits Conference, January 2019

I really enjoy concerts and music festivals, such as Tennessee Bonnaroo, which I attend every year. While I can find something to appreciate about almost any kind of music, I am particularly drawn to the indie stuff. On Zoom calls, people will sometimes ask me about the album cover on the wall behind me — it’s “Lost in the Dream” by The War on Drugs, and I highly recommend it.