The Corporate Transparency Act requires certain entities to report information about themselves and their beneficial owners, including a taxpayer identification number. READ MORE

(By accessing, browsing or using the pages below, you agree to the Blog Conditions of Use/Disclaimer available under "Links.")

The Corporate Transparency Act requires certain entities to report information about themselves and their beneficial owners, including a taxpayer identification number. READ MORE

If you transfer a life insurance policy in exchange for money or other property, the death benefit may become subject to income tax. This rule applies even to some nontaxable transfers. Furthermore, any policy issued to a business entity after August 17, 2006 may be subject to income tax if certain documentation was not on file when the policy was issued. READ MORE

When a married person dies and passes assets outright or in a qualifying trust to the surviving spouse, those assets receive a new basis and are not subject to estate taxes. Under current tax laws, this provides a unique estate planning opportunities through unused exemptions and marital trusts. READ MORE

Steve Gorin joined two episodes of the Simply Tax podcast to provide more insight on the nuances and considerations of structuring a business as a C corporation, an S corporation, or a partnership. READ MORE

The 2017 tax reform introduced a deduction equal to 20% of qualified business income from pass-through entities, subject to various limitations. Proposed regulations issued on August 16, 2018 clarify the government’s current view of these rules. READ MORE

Tax Reform on Choice of Business Entity, summarizes considerations in choosing whether to continue being an S corporation or convert to a C corporation. In most cases, exit planning suggests remaining an S corporation. However, in some cases, one may decide to convert to being a C corporation. READ MORE

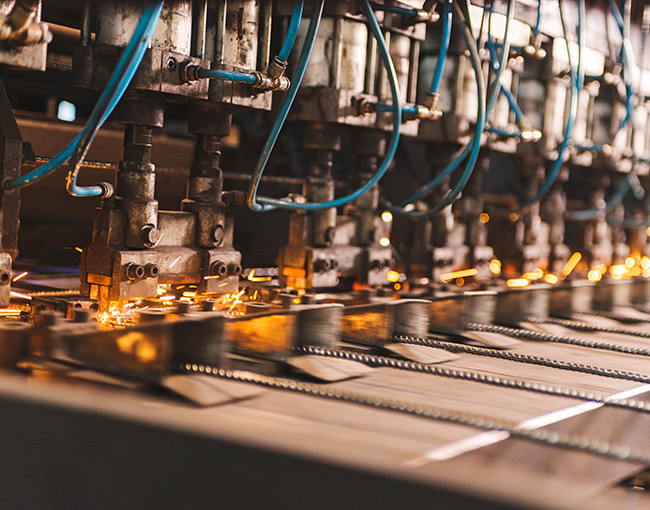

Effective in 2018, changes in partnership audit rules may apply various consequences to partnerships (including LLCs taxed as such). READ MORE

Taxpayers have won and lost cases seeking to avoid self-employment tax on their income as members of limited liability companies. The IRS has had victories (a) disregarding an attempt to shift self-employment income into an S corporation, and (b) making taxpayers pay tax and then sue for a refund when contesting IRS claims that S corporation distributions were really compensation. To tie together 2017 developments, READ MORE

Any compensation the owner receives is subject to FICA tax, which imposes an equivalent burden. And the IRS frequently attacks owners who receive cash distributions from an S corporation, arguing that the distributions were essentially disguised compensation. The IRS often wins those cases, in full or in part, and may collect penalties. READ MORE

A recent Tax Court opinion, Castigliola v. Commissioner, held that an active LLC member was liable for SE tax. This article describes that case, compares and contrasts that case to the Hardy case, and provides planning suggestions. READ MORE

Here we examine why the U.S. Tax Court rejected a financial consultant’s efforts to shift income to an S corporation to save self-employment tax, and how another approach may have been more successful in avoiding SE tax. READ MORE

Self-employment (SE) tax is one of the driving forces when a tax advisor recommends what type of entity to use for one’s business. READ MORE

As we prepare for perhaps another round of major tax law changes, you might want to consider the status of your clients’ legal postures. Making a client’s business structure more nimble or setting the stage to obtain outside or inside basis step-up could offer some solutions. READ MORE

Each January, the University of Miami hosts the Heckerling Institute on Estate Planning, the country’s largest estate planning seminar. Here I provide links to the seminar summary reports sent to my newsletter subscribers, along with parts of my commentaries. READ MORE

As we near tax season, below are some tips for CPAs when planning and preparing tax returns for trusts, along with a link to an upcoming webinar on this very topic. READ MORE

This article discusses key ideas used in reducing or eliminating gain subject to tax when you sell an interest in your business or when your business sells part or all its assets. These ideas can also possibly help those who buy or inherit a business obtain better tax write-offs. READ MORE

Beware that an employer-owned life insurance contract might not qualify for the usual exclusion from regular income tax. That trap may also apply to buy-sell life insurance owned by the company, whether or not the person who is insured is an employee. READ MORE

NOTICE.

Although we would like to hear from you, we cannot represent you until we know that

doing so will not create a conflict of interest. Also, we cannot treat unsolicited

information as confidential. Accordingly, please do not send us any information

about any matter that may involve you until you receive a written statement from

us that we represent you (an ‘engagement letter’).

By clicking the ‘ACCEPT’ button, you agree that we may review any information you transmit to us. You recognize that our review of your information, even if you submitted it in a good faith effort to retain us, and, further, even if you consider it confidential, does not preclude us from representing another client directly adverse to you, even in a matter where that information could and will be used against you. Please click the ‘ACCEPT’ button if you understand and accept the foregoing statement and wish to proceed.